USH Newsletter 10/15/25

Vote for the Entire

Unite Sleepy Hollow Slate

on November 4th!

Sleepy Hollow's Financial Budget

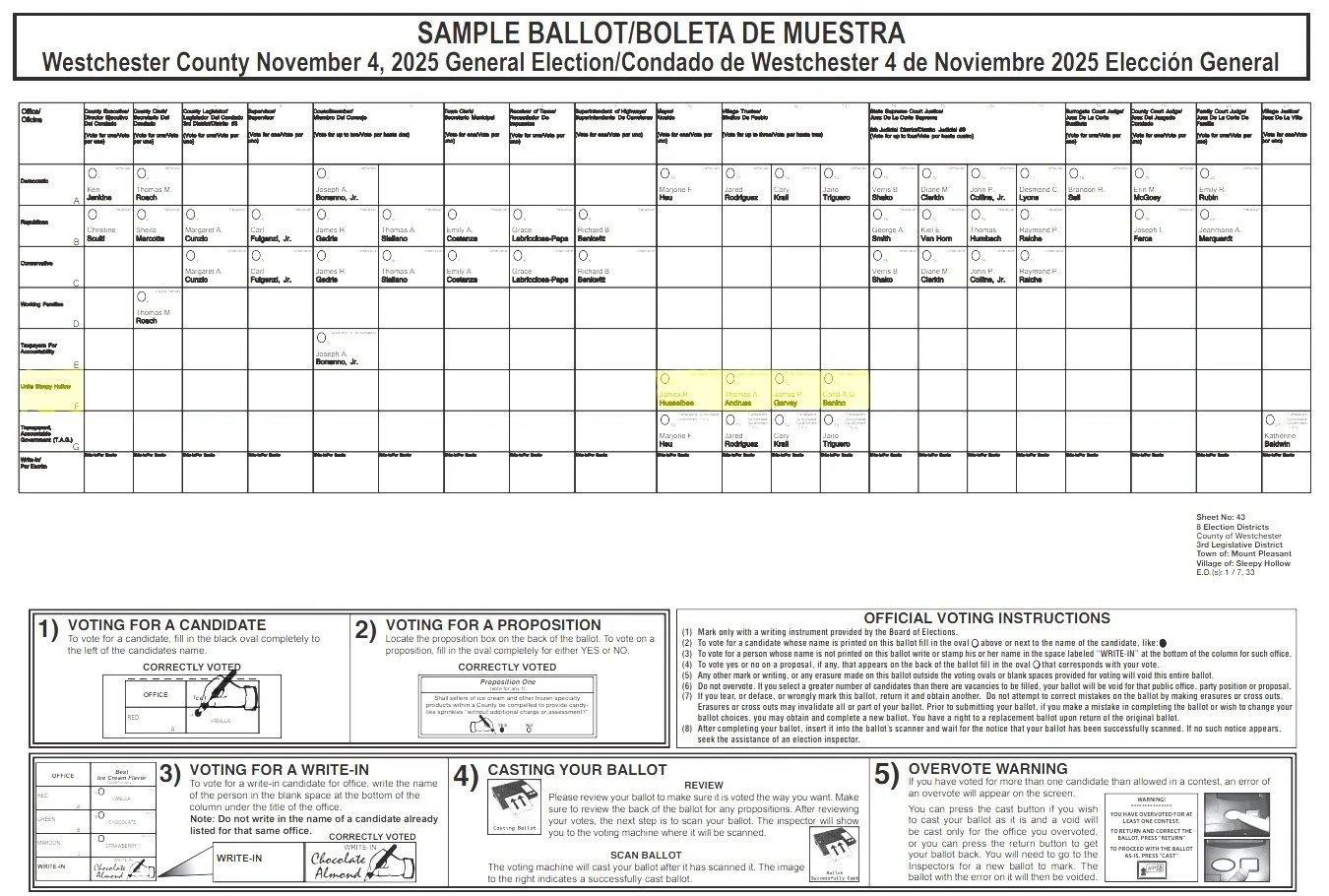

Village finances have become the central issue in this year's campaign for Mayor and three trustee seats. After property tax increases of 23.5% over the last two years (increases which were supported by the Dem/TAG team and opposed by Unite Sleepy Hollow) Village residents are rightly asking, "Where has the money gone?" They are also questioning why Dem/TAG candidates Hsu and Rodriguez are claiming the village is near bankruptcy.

Our opponents say they understand the Village's finances, yet they recently admitted in The Hudson Independent that they would only "conduct a thorough financial analysis and plan IF ELECTED".

Via The Hudson Independent

USH has already completed a detailed analysis of village audits and has developed a budget plan for the next five fiscal years. This plan includes expected tax CUTS of 4-5% and 2-3% over the next two fiscal years. A review of recent audits clearly shows a history of poor budgeting that has led to the recent tax hikes.

Dem/TAG's History of Poor Budgeting

When national party politics seep into village government, the focus shifts away from what truly matters. We believe this approach carries significant risks:

For the five fiscal years ending in May 2024, the village's general fund revenue was $8.4 million over the budgeted amounts. Year after year, revenue is significantly higher than forecasted.

In the last three fiscal years ending May 2024, the adopted budget allocated a total of $6 million from the general fund for future expenditures. However, the village only spent $1.3 million of that amount.

For the fiscal year 2025 budget, the board increased property taxes by 14.85% and assigned another $2.6 million from the General Fund Balance for future spending. All signs suggest that revenues will once again be higher than forecasted and that the majority of the assigned $2.6 million was not spent.

Compounding this error, for the 2026 budget, the Board approved using another $1.5 million from the Fund Balance and raised property taxes an additional 7.58%.

Preliminary financial results for the fiscal year ending May 2025 have yet to be released despite it being 4 months since the end of the fiscal year. Notwithstanding, based on USH estimates and TAG’s history of poor budgeting, we expect that revenues will again exceed forecasts, that expenses will be lower than budgeted, and that the Total Fund Balance is much greater than what the Dem/TAG team expects.

USH estimates that by the end of fiscal year 2026 the Total Village Fund Balance will exceed $10 million (helped by an expected $4.6 million from the GM settlement), well in excess of NY State Comptroller guidance. Our opponents expressed their amusement at these assertions which only reveal their complete ignorance of the published audits and their history of poor budgeting. They claim that the tax increases are modest dollar amounts, and that Village property taxes are only a small portion of your overall tax base. They must have unlimited bank accounts.

What mayoral candidate Hsu and current trustee and candidate, Jared Rodriguez, continually get wrong is the poor budgeting that has led to the tax increases. Ms. Hsu publicly claims that a vote for USH would lead to the bankruptcy of the Village necessitating a state takeover, something that has been reiterated by her running mates. It is difficult to understand how they could come to this conclusion when the Village property tax base has grown significantly due to the Edge-on-Hudson development. In fact, the Edge contribution to the Village budget will be more than $4 million this fiscal year and is expected to grow to over $10 million when completed.

Our Village Debt

The Village had a total of $62 million in debt as of May 31, 2025, divided between $29.6 million owed by the village, and $32.5 million owed by the LDC (which is ultimately the Village’s obligation). This level of debt is manageable, most of which pays ONLY 3% interest, with principal payments due over a long period of time. The annual payment on this debt peaked in FY 2025 at $4.9 million and are trending downward. By 2030, total village debt will be reduced to $48.9 million and annual payments on the debt will be just $4 million.

USH believes that borrowing at such rates is prudent for long-term projects. Our basic philosophy is that for capital investments, prudent borrowing enables payments to be spread over a long-time frame and paid by the residents living in the Village during those years. Our opponents, however, apparently think that the debt burden is excessive, and that all capital costs should be borne by current residents, which would precipitate an additional massive tax increase.

Our opponents also claim that such debt amounts would cause the NY Office of the State Comptroller (OSC) to conduct a takeover of Village finances. This is preposterous and just one example of their fearmongering. The OSC employs a stress test process to identify at-risk municipalities, of which Sleepy Hollow is absent. Our auditor has verified our Aa3 credit rating that signifies high quality, reiterated by Moody’s Investor Service in February 2024.

Sleepy Hollow's Budget Forecast

The USH team financial analysis below is based on actual audited May 2024 financial results, estimates for the fiscal years ending May 2025 and May 2026, and forecasts for the subsequent 5 fiscal years. As previously discussed, TAG leadership has overestimated budgeted expenses, and while we expect revenues for both 2025 and 2026 fiscal years to be higher than forecasted, we use adopted budget amounts. We then use 3% as the annual expense increase and estimate the additional revenues from the Edge on Hudson development, as well as incorporate the $4.6 million payment to the Village from the GM settlement. Based on these forecasts, we expect to utilize almost $1 million of the general fund balance in 2027 and 2028 fiscal years to roll back a portion of recent tax increases, enabling a 4.36% tax cut in FY 2027, and a 2.63% tax cut in FY 2028. Given the ongoing Edge revenue increased contributions, we expect subsequent year residential tax changes to be flat to lower.

In Conclusion

The Dem/TAG team has not done the math on village finances. They ignore the history of higher revenue generated and lower expenses than budgeted, cried wolf that village finances are precarious, and shouldered the burden on village taxpayers through higher property taxes. They are completely unqualified to be stewards of taxpayers’ money.

On the other hand, the USH team has provided extensive analysis and justification for voting against the recent property tax increases, explaining recent periods of budget malfeasance, and providing a reasonable basis for estimating future residential tax rates. We believe that before the November 4 the election voters deserve this analysis to better understand the overall picture of village finances, and to be certain that the team you are voting for has the acumen to be responsible stewards of your money.